GST Changes and How It Impacts You

Dear Valued Seller,

In line with the Finance Ministry to reduce the GST rate from current 6% to 0%, starting 1st of June, all GST charges will be amended from 6% to 0%. Here is a list of changes that will impact you.

1. GST Changes in Lelong Services & Fees

All agreements such as Webstore & Netpay will be revised to reflect on GST changes. GST charges on fees such as transaction fees, payment gateway fees, boosting fees & store renewal fees will be revised from 6% to 0%.

2. Changes in Seller Store

All standard-rated supply will be amended from 6% to 0%. Sellers are not required to change the Types of Supply under GST setting, however, you may need to adjust price depending on your store setting.

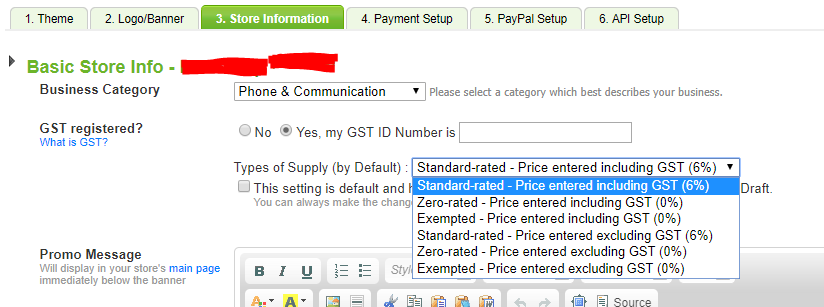

How to Check Your GST Setting

To check your GST setting, kindly follow the steps below:

- Login to your Seller Panel

- Click on D. My Store > 6. Store Setting

- Click on 3. Store Information

- View the GST registered column, you will be able to see your GST ID and setting.

Here is where you can see your GST ID & setting.

What You Need To Do

Depending on the GST setting, you may or may not required to update your price & shipping fee. Here is two different scenarios:

1. You Selected Price Entered Excluding GST (6%)

You are not required to take any action as the system will revise the rate from 6% to 0% by 1st of June. Your product prices & shipping fee will be the same as what you inserted in the pricing column.

2. You Selected Price Entered Including GST (6%)

You will need to edit your pricing & shipping fee and here is how you can do it:

A. Manual Update Through Mass Edit:

You can mass update your live listing by 1st of June by using our mass edit feature. All you need to do is just to download the CSV file, update the pricing and upload back to the system.

B. We Can Help

As this is quite an intimidating practice, we can help to adjust the prices by 6% flat. You will need to fill up the form here.

Please take note that it will be a flat 6% reduction from the product prices so you will observe some weird decimal points. More examples are shown here.

Note: Form will be closed by 30th of May, 6pm so we have sufficient time to roll out the changes.

F.A.Q

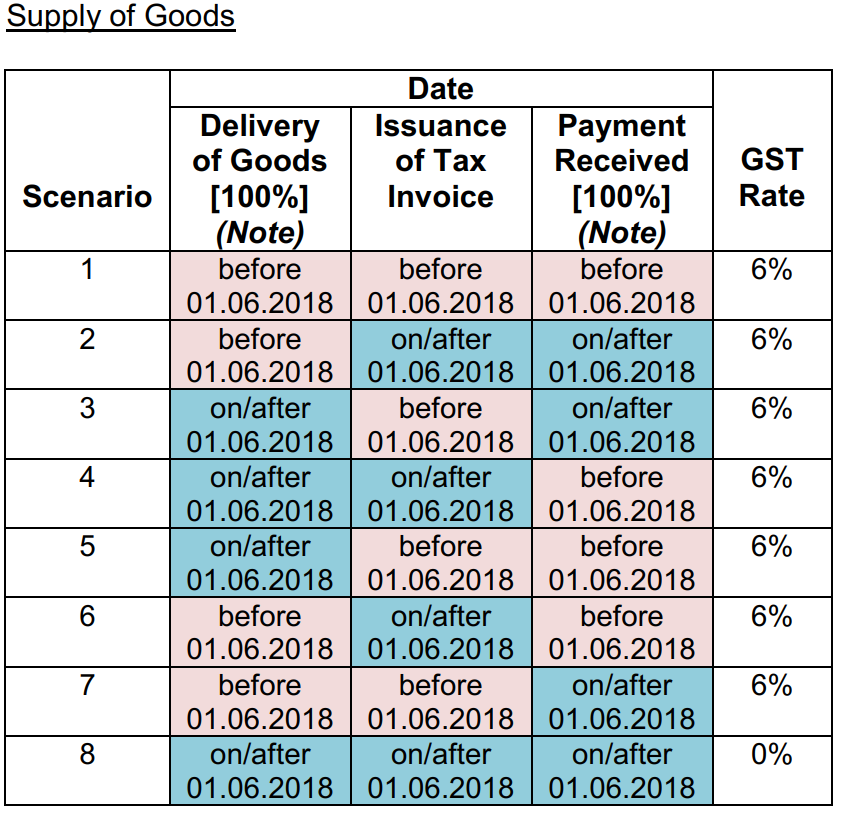

- Should seller sell goods at 6% GST or GST 0%?

- Generally, as long as the order is placed before 1st of June, regardless of payment or shipping status, the buyer will need to pay the 6% GST charges.

- You can also refer to the following table pertaining to the time of supply in order to determine the imposition of GST rate:

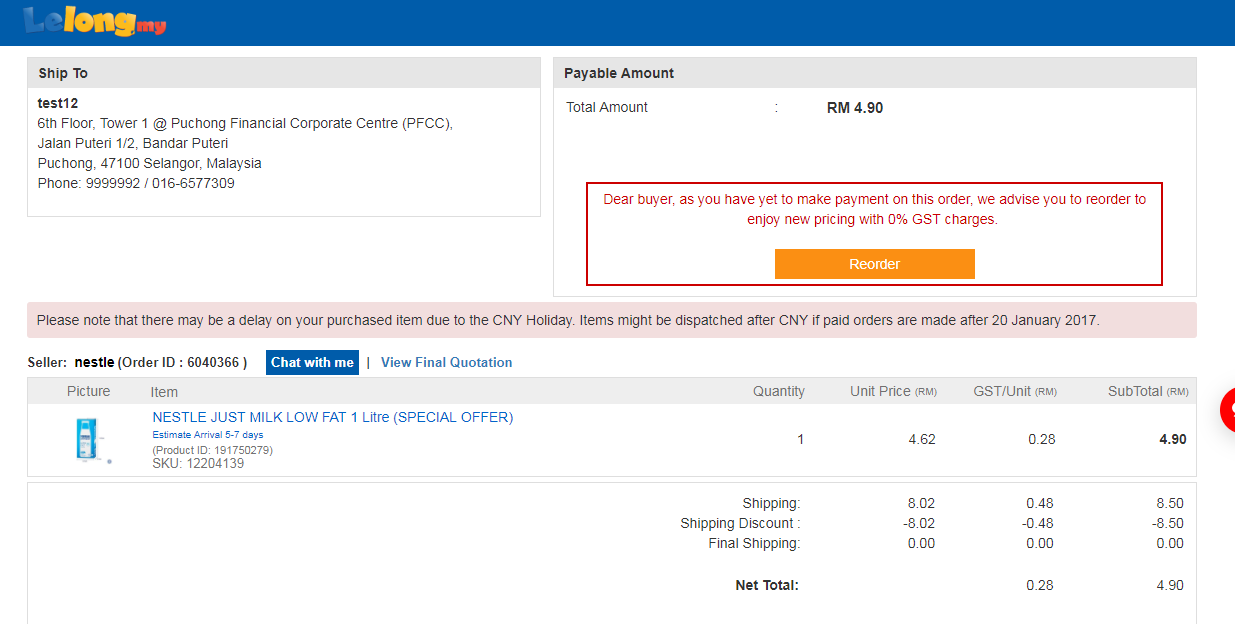

- What if a buyer placed an order before 31st May 2018, but has not made payment by 31st of May 2018?

- Sellers are not required to cancel order.

- On 1st June 2018, Lelong.my will make an adjustment on Check Out page to prompt buyer to Reorder.

- What if my items are featured on Star Deals and a buyer placed an order but yet to make payment by 31st May 2018?

- The order on Star Deals will be canceled automatically by 1st of June

Should you have any queries, please do not hesitate to contact us here.