Transition from GST to SST 2018

Dear Valued Seller,

The Ministry of Finance (MoF) announced that Sales and Service Tax (SST) which administered by the Royal Malaysian Customs Department (RMCD) will come into effect in Malaysia on 1st September 2018.

Here is a list of changes starting from 1st September 2018 that you need to take note:

1. Changes in Lelong Services & Fees

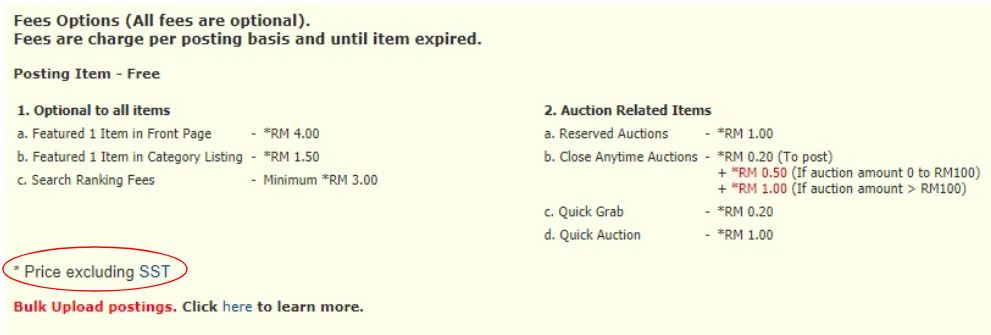

Services below will be added with 6% SST:

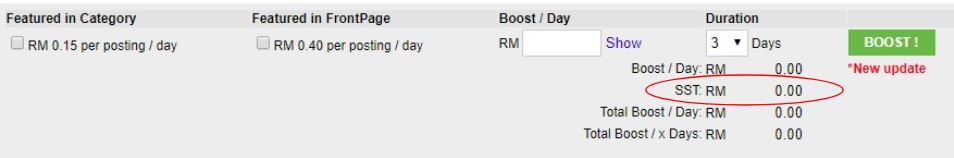

- Advertisement (e.g: boost feature)

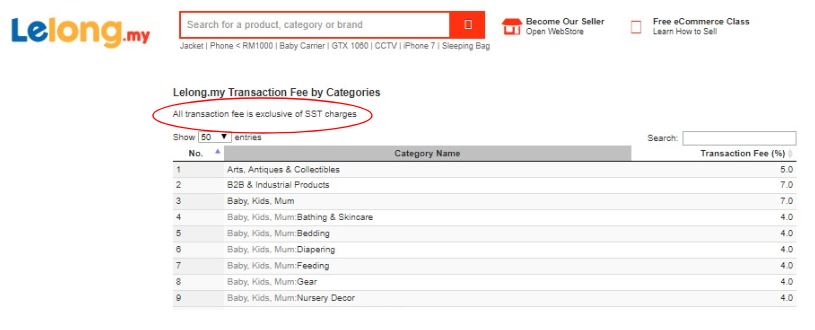

- Transaction fee/ LEC fee

- Posting fee

- Plugin

- Auction fee

- Netpay transaction fee & settlement fee

- New store fee

- Store renewal fee

2. Lelong website changes in compliance with SST

All GST related details will be removed from website and replaced with SST in related fields.

*changes will be reflected on 1st September.

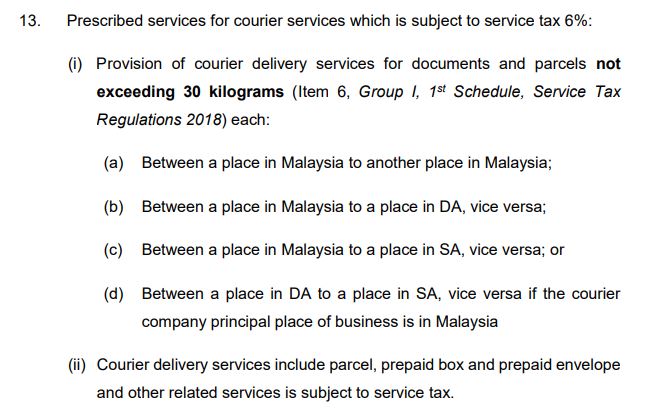

3. Courier delivery services

Parcel that is under 30kg is taxable, you may check out more details with your courier service provider or refer here.

Should you have any queries, please do not hesitate to contact us here.